Business Management

The Lake Erie Regional Grape Program is designed to serve the needs of regional growers and wineries. Long-term trends in bulk juice production have held steady in the region for decades. Most profit growth requires improvements in production and management efficiency. Specialty wine production has seen steady growth for the past decade. Bulk wine production is a market that continues to shift and evolve with consumer preferences. With those realities in mind, we strive to give growers the tools to improve their generational sustainability and fiscal health.

Value Added Producer Grants Open!

Now open in both New York and Pennsylvania

Application Window: Opens January 15, 2026

Electronic applications will be accepted via the VAPG application portal until 1:00 p.m. Eastern on April 15, 2026.

More info can be read HERE.

What Does the VAPG Program Do?

The Value-Added Producer Grant (VAPG) program helps U.S. agricultural producers enter into value-added activities that:

Generate new products from raw agricultural commodities

Create and expand marketing opportunities

Increase producer income through enhanced product value and market reach

These grants support either:

Planning activities (e.g., feasibility studies, business and marketing plans)

Working capital needs (e.g., processing, packaging, advertising, inventory, and salaries)

Who Gets Priority?

Applicants may receive priority consideration if they meet any of the following criteria:

Beginning farmer or rancher

Veteran farmer or rancher

Socially disadvantaged farmer or rancher

Small or medium-sized farm or ranch structured as a family farm

Farmer or rancher cooperative

Proposing a Mid-Tier Value Chain project

Additionally, 10% of total funds are reserved for:

Beginning, veteran, and socially disadvantaged farmers/ranchers

Mid-tier value chain proposals

Food safety projects where the majority of funds improve market access

Funding Overview

Total Available Funding: Approximately $25 million

Maximum Grant Amounts:

Planning Grants: Up to $50,000

Working Capital Grants: Up to $200,000

Matching Requirement: 1:1 match (100% of the grant amount), which may include cash or eligible in-kind contributions

Grants are awarded through a nationally competitive process based on criteria outlined in 7 CFR 4284, Subpart J.

Who May Apply?

Eligible applicants include:

Agricultural producers (including harvesters and steering committees)

Agricultural producer groups

Farmer- or rancher-cooperatives

Majority-controlled producer-based business ventures

Applicants must demonstrate that they:

Own and produce more than 50% of the raw commodity

Will retain greater revenue from the value-added product than from the raw commodity alone

How to Check Eligibility

A VAPG Self-Assessment Survey is available to help determine your eligibility. While not required, it is strongly encouraged before beginning the application process.

Get Prepared for Two New York Farm Viability Institute Grants

Two New York Farm Viability Institute grants are set to open in early 2026. Both are round two of the grants offered last year.

The first grant to watch out for is the NYS Beginning Farmer Competitive Grant Program. NYFVI anticipates launching Round Two, which will award $1.7 million early in 2026. The program will continue to seek proposals that will advance Beginning Farmer’s plan to grow their business and become a financially sustainable, independent, agricultural enterprise.

Potential applicants are encouraged to review the analysis as well as the grant information and resources that were provided for the first round here.

The second grant is the NYS Grown & Certified ITRD Grant Program. It is also expected to be released in early 2026. The program will continue to seek proposals from farm and food businesses that are participating in the NYS Grown & Certified program.

Potential applicants are encouraged to review the information and resources provided for the first round here.

The NYFVI will also notify you when applications are open for submission here: SIGN UP FOR ROUND 2 RELEASE NOTIFICATIONS.

Andrew will share when these grants open, and as always, will be available to help growers with applications and questions

NY Wine & Grape Classifieds

If you are looking to sell or purchase wine and grape equipment, bulk wine, or grapes, or have a job posting for your operation, we encourage you to check out the New York Grape & Wine Classifieds. The classifieds website can be found here.

Andrew has recently taken over running this site, and although it has historically been used more in the Finger Lakes region, he is excited to have wineries and growers from across New York State and Pennsylvania start using it more.

It’s free to use, and is a good way to find a deal and sell anything wine and/or grape-related. A guide on how to make an account and post an ad can be found here.

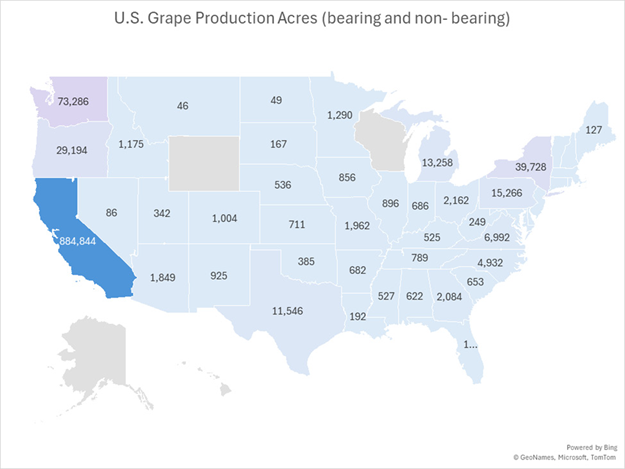

Survey of Unsold Grapes in PA and NY

With the 2025 grape harvest wrapped up, there are seemingly more grapes left in the vineyards this year than in years past. While this year’s quality was reportedly high, the grape market, both for wine and juice grapes, has continued to become more and more saturated. In turn, growers have shared reports of some grapes not having buyers. No or low demand, dropping of past contracts, and allocation of crops have been reported across the industry. To capture this data and to show the economic impact of the current market conditions on grape growers in Pennsylvania and New York, Andrew Holden with the Lake Erie Regional Grape Program has created a survey for growers to complete. Please see the request below:

The Lake Erie Regional Grape Program, along with our collaborating Land Grant Universities (Penn State University Extension & Cornell University Extension) are asking you to contribute to the 2025 Unmarketable Grapes Survey. Growers from both New York and Pennsylvania State are encouraged to complete the following form.

Survey Link: https://pennstate.qualtrics.com/jfe/form/SV_9TEV2wdiHGqknEa

You are asked to answer questions about the grape varieties you grew in 2025 and couldn't sell due to current market conditions. Please share the approximate unsold tonnage and the value per ton of those grapes (This could be what you expected to receive or what you received last year).

The purpose of this survey is to estimate and report on the economic impact that is the result of the current grape market conditions. Results could be used by growers, industry groups, and politicians to make decisions regarding growing, marketing and/or policy change.

We will publish a report of the results from the survey in the Lake Erie Regional Grape Program Crop Update. If you are not a member of the LERGP, you can find information on how to enroll by contacting Kate Robinson at 716-792-2800 or by email at kjr45@cornell.edu. The report will also be published publicly from each respective university and or grape growing region.

Please be assured that your responses are completely confidential. We will only report data regarding tonnage, average prices, and minimum and maximum prices per ton by variety received so that no individual's answers will ever be identified.

If you have any questions about this survey or its outcomes, please contact Andrew Holden, Extension Educator at 716-640-2656 or azh6192@psu.edu.

Current News and Updates:

Past Business Management Content:

-

October 26, 2023

Please read the letter that was sent to the EPA regarding the Herbicide Strategy Framework to Reduce Exposure of Federally Listed Endangered and Threatened Species and Designated Critical Habitats from the Use of Conventional Agricultural Herbicides. Many National, State, and Regional Agricultural groups have signed this letter voicing their non-support for this proposed strategy and the reasons why.

Ag Group Herbicide Strategy Comments (pdf; 496KB) -

August 2, 2023

NYS Trooper, Matt Luft, presented on Commercial Vehicle Awareness at CLEREL, including a mock truck inspection to raise awareness to what they look for when doing an inspection. The power point presentation slides that he used are attached for your reference.

Commercial Vehicle Awareness (pdf; 4945KB)NYS Trooper, Matt Luft, presentation

-

April 1, 2022

Project ideas may include:

Drainage

Soil amendments

Fencing

Crop changes or improvements

Land renovations

Farm structure improvements

Eligibility Requirements:

Chautauqua County resident

Farm business designation — File Schedule F

Each project must include a business plan indicating planned improvements. Don't have a plan? We can help you develop one, free of charge.

Visit: http://chautauqua.cce.cornell.edu/agriculture

Contact: Lisa Kempisty, Extension Educator

(716) 664-9502 Ext. 203

ljk4@cornell.edu

525 Falconer Street

P.O. Box 20

Jamestown, NY 14702-0020Funding for this program is limited. All completed applications will be considered and awarded on a first come first serve basis. Eligible projects may receive a grant of up to $10,000 per farm. Grant funds can reimburse up to 10% of removal fees and up to 25% of remediation or improvement expenses.

Application (pdf; 131KB) -

Kevin Martin, Extension Educator, Business Management

Lake Erie Regional Grape ProgramJuly 19, 2017

Portland, NEW YORK (7/20/17) --

Kevin Martin, from the Lake Erie Regional Grape Program (Penn State University), is currently creating baseline economic data to provide regional grape growers with commercialization strategies for spatial vineyard management. Baseline economic data will be used to measure the economic benefits of next generation vineyard technology. The local application of this technology focuses on the sustainability of the bulk juice industry. The industry stands to benefit from increasing average vineyard health while minimizing management inputs. Variable vineyard management offers the potential to increase yields or reduce vineyard input costs.Spatial vineyard management requires the use of tractor mounted sensors logging sensor data and GPS location. Once data is reviewed, informed management decisions can be applied at a variable rate to the vineyard block. Variable rate management may involve targeted use of hand-labor or traditional vineyard maintenance equipment. Variable rate vineyard management may also involve modifying equipment and adding technology to allow the machine to manage vineyards differentially based on sensor data.

The adoption of technology may require substantial investment on the part of the grower. To maximize the benefits of technology, LERGP is working with grape growers to familiarize them with sensors and data management. "This work goes beyond mapping underperforming areas," Martin states, "commercialization of technology is going to require increasing average yields in those areas to justify the investment in sensor and GPS technology. By surveying local growers and variability in their vineyard, we will begin to understand the potential economic impact sensor technology can have on our grape industry."Efficient Vineyard is a global effort to improve the performance of vineyards, particularly those geared toward bulk production. The project is funded by USDA Specialty Crops Research Initiative. More information on the research and extension team, sensors and the project can be found at efficientvineyard.com

Profit maps (pdf; 459KB)Variable rate vineyard mapping and profit map

-

Kevin Martin, Extension Educator, Business Management

Lake Erie Regional Grape ProgramJune 4, 2015

-

Kevin Martin, Extension Educator, Business Management

Lake Erie Regional Grape ProgramMarch 6, 2014

Please take a look at the following sample partnership agreement. The agreement is designed to serve as a template to foster discussion regarding issues that need to be considered in any partnership, particularly one involving multiple generations with disparate goals. At twelve pages long, there is a lot there. Take a look at each section heading, which highlights the necessary sections. Language within those sections should be changed based on individual circumstances. As such, this partnership agreement should not be construed as a valid legal document or legal advice. Use it to inspire decisions about the way you want your future partnership, LLC or Corporation to look. -

Edith Byrne, Association Program Educator I

Lake Erie Regional Grape ProgramMarch 26, 2013

Videos created through projects funded by North East Center for Risk Management Education, New York Farm Viability Institute, NYS IPM Program and LERGP.

Please click on the link below to view on the LERGP You Tube Video Page: -

Kevin Martin, Extension Educator, Business Management

Lake Erie Regional Grape ProgramMarch 21, 2013

Social Security Calculator: Click here for downloadSocial Security Calculator : Instructions

Use the above spreadsheet to estimate your future Social Security Benefits

Detailed Instructions

Find your wage Information. Your wage information can be found at: http://www.socialsecurity.gov/myaccount/

Enter wage data on the “Age and Wage" sheet. See step one to find historical wage information. Future wages will significantly impact your SSI benefit. Enter your anticipated earnings to see the impact of working longer or harder.

On the same sheet enter your Age Information. Enter your current age. Enter your expected age of retirement. Enter your full retirement age

Enter anticipated inflation from now until retirement

-

Kevin Martin, Extension Educator, Business Management

Lake Erie Regional Grape ProgramLast Modified: March 19, 2013

Assumptions

Land: It is assumed that land is already owned by the grower as that is the most common practice. Open land itself may be valued at $1,500 per acre. Open land in Chautauqua County is valued at $800 – $2,000 per acre for agriculture purposes. Annual ROI on this investment could be as little as $45.

Vineyard layout: Spacing is assumed 7×9 or 658 vines per acre.

Tile drainage: While tile drainage is not required on soil types most well drained soil already has an established vineyard. A common tile drainage system would include 4″ pipes at 18′ spacing with an 8″ mainline.

Trellis system: 220 4″ pressure treated posts per acre as well as 35 end posts and anchors per acre.

Wage Rates: Wage rates reflect the actual costs of growers of $12 per hour for unskilled labor. Piece rate wages for pruning are assumed at .3 per vine.

Harvest and Hauling: Grapes are assumed harvested and hauled by the owner operator at a cost of $120 per acre.

Machinery: Machinery depreciation was estimated at a discounted rate based on the assumption that economies of scale will reduce per acre depreciation costs for new plantings.

Overhead: Similar to machinery, overhead costs should rise as the grower expands holdings but per acre costs should fall. The overall savings are captured entirely in the new planting acreage and estimates of new overhead costs are included.

Cost of Capital: A 2.5% interest rate change on capital investment and operating capital was changed. This rate represents a real rate based on a six percent nominal rate of interest and an expected rate of inflation of 4%.

Yields & Prices: Revenue is displayed as a matrix as fluctuations in yield and price will continue to be volatile. We could estimate an average, but you will never have an average year. The revenue matrix illustrates the floor, ceiling and expected revenue the planting may have.

Vineyard Establishment Costs

The good news is, the cost of vineyard establishment does not impact the cash flow as dramatically as the total cost of the vineyard does. Establishing a vineyard will normally increase unpaid labor costs quite substantially. Most of the establishment labor is either low-skilled labor or completed by grower owners and family.

Even with this competitive advantage, it often makes more sense to purchase an existing vineyard.

Realizing the benefits of a new trellis, new vines, and orderly planting simply take far too long to justify any interest charges. Even any reasonable ROR will likely be greater from purchased vineyards, rather than newly planted vineyards.

Tile is a significant variable in vineyard plantings. Growers have experimented with plowing tile in to reduce such high installation costs. These costs clearly illustrate why most well drained soil already has existing plantings. Planting on well drained soil could result in establishment cash outlays as low as $2,600 per acre. Also, at $3,900 per acre this cost should be one specifically targeted by the grower. Negotiate with the installer, entertain more efficient installation methods, and properly assess exactly how much drainage the site requires. Establishment labor and maintenance until cropping begins will increase those costs, but could potentially result in less expense than a well-drained gravel site with an existing planting. Total labor for trellis construction, planting, and fertilizer application is 16 hours. Cash outlay for that labor will vary between $250 per acre and $80 per acre. For a large grower with a salaried employee costs could be lower as much of this additional labor can take place outside of the normal growing season.

While planting costs vary, even if expenses are comparable to existing plantings, it can make economic sense to plant. Minimizing unproductive land along with the upkeep and taxes associated with that land improve efficiency.

Macroeconomic conditions make this a particularly interesting time for investment. Money is generally this cheap two or three times a century. Credit requirements are tight but for those with capital a reasonable return on investment (ROR) in a long-term investment is not available. The Federal Reserve continues to manipulate long-term rates to encourage investment. Thirty-year notes currently yield 4.55%, a mere 2% above long-term inflation. Given current inflationary pressure, actual yields could easily average 1%. Ten-year notes currently yield 1.82%. Actual rates could easily fall below 0% if the economy recovers before 2016.

Historically the major concern with expansion was that the grower would use a great deal of capital for a ROR that could just not compete with the market. At this time the ROR in the market looks downright awful. Anticipating negative yields over the next decade is not at all a stretch.

-

March 13, 2013

Not knowing your Cost of Production: COP, or what it costs you to produce one unit is the lynchpin for profit. Every management decision must be weighed against how it affects your COP. Too few farmers know their cost of production and if you do not know your COP, can you truly be considered in the business of farming?

No plan for transferring the farm to the next generation: Life happens, but without adequate planning and preparation it may not happen the way you desire. Transitioning the farm is a long term, on-going and arduous process encompassing every segment of the farm and family. You need to start early, involve everyone, and modify as life provides changes.

Inadequate financial recordkeeping: If you keep your financial records only for tax preparation, Uncle Sam appreciates your efforts but you have given up a management tool for determining COP and making profitable decisions. Without adequate records for making decisions your outcomes are based on guesses and wishes.

Lack of a clearly defined business plan: Farmers are great at planning day-to-day production activities but long-term plans get lost in the every day work. Planting the crop, breeding the cow, and marketing the crop must happen, but determining how each cog relates to profitability will keep you in business for the next generation.

Lack of Communication: Farmers tend to be uncommunicative, but family businesses have many official and unofficial partners with a stake in the business. It is important to keep these partners (spouse, children, employees, lender, equipment dealer, farm supply dealer, etc.) aware of what you are doing at least to the level of their involvement.

Avoiding or deferring taxes: The desire to not pay taxes leads to tax decisions that may have long-term negative implications rather than decisions that manage for long-term profitability. We often forget that the tax bill will come due some time in the future.

Lack of financial reserves: Both businesses and families lack the financial reserves necessary to make weathering tough times less difficult. This current economic downturn has changed the landscape and businesses will need to depend on these reserves in conjunction with tools provided by their lender.

Not managing family living expenses: The family can be a black hole in sucking up money. The only way to manage that black hole is to know what it costs your family to live and then to manage your resources.

Following your neighbor: Farming operations are different and the factors that drive your neighbor's decisions are not the same factors you deal with. Why should you follow him? I bet he did not get to be successful following his neighbor.

Jumping on the latest/newest/hottest enterprise: The learning curve for new enterprises is steep and expensive. A lot of homework needs to be done before launching a new enterprise, and it is rare to see that homework done. Because an enterprise is successful somewhere does not mean you can make it work here, but the reverse is also true. The right idea, coupled with the right resources, markets, and management traits are essential in raising an idea from the kitchen table to a profitable enterprise.

Not training the next generation: Farmers are good at teaching the younger generation about production but less so about financial management. This has a lot to do with a lack of communication, murky long-term plans, and a willingness to share control. If the farm is going to survive for generations, that training must occur.

-

Kevin Martin, Extension Educator, Business Management

Lake Erie Regional Grape ProgramMarch 13, 2013

New York State recently passed the Wage Theft Prevention Act. This law is similar to new requirements in Massachusetts, and Illinois. In the past record keeping requirements were similar to Pennsylvania. Employers have to document standard payroll data such as hourly rate, hours worked, and ensure piece rate employees were making at least minimum wage. These requirements are in addition to the new hire notices that went into effect on October 26, 2009. This law takes effect in April 2010.

Simply handing cash or even checks to someone may seem adequate. However, failure to follow the letter of the law may lead to liability for the legal definition of wage theft. Inadequate record keeping may leave your business vulnerable to fraudulent claims of wage theft.

Allegations of wage theft for grape farmers often arise because of the culture surrounding hand pruning. A bilingual worker with legal status manages the crew and may take payments directly for contractual work completed. This ‘crew-leader’ may then make payments to other pruners. While this is common practice in other industries, it is specifically banned in agriculture by federal law. Crew leaders must be registered and there are essentially no registered crew leaders. This puts the responsibility on the grower to pay employees directly without an intermediary. Many growers continue to allow a leader to manage the group but generally pay employees directly. Without allowing a pseudo-leader it can be challenging to find labor. By allowing such a leader, but still paying employees directly, it can be challenging to comply with all labor law requirements because of the lack of communication and contact you have with your employees.

The Wage Theft Prevention Act increases record keeping requirements. Employers must provide the following information in the Employee’s primary language:Rate of pay

Allowances such as meals or lodging

Regular pay day

Name of Employer

Any ‘doing business as’ names

Physical address of Employer’s office

Telephone number

With each wage payment Employers must provide:

Dates of work

Rate of work

Gross Wages

Deductions

Allowances

Net Wages

Non-Exempt employee payroll statement must include overtime rate and overtime hours worked

Additional penalties of wage theft include $50 per workweek for not providing the information above. In addition, employers will have tort liability to employees of $100 per workweek, up to $2,500 and attorney fees.

The NYS Department of Labor is charged with publishing a bilingual form to assist employers in meeting these requirements. Many of these are available at: http://www.labor.state.ny.us/workerprotection/wp_forms_documents.shtm.

Explanation Of The Law (pdf; 279KB) -

March 12, 2013

Corporations, LLC, S-Corps and other business organizations have their place. In the excitement of limiting liability and developing into a sophisticated operation many growers look to these organizations. For some growers these organizations are absolutely essential and a bargain value. For small growers the tools offered are not always appropriate and the costs are disproportionate. Sole proprietorships and partnerships offer no liability protection, no flexibility in tax structure and other similar limitations. However, these organizations lower costs for insurance, filing fees, accounting services, and legal fees.

This sample partnership offers a method of transferring ownership to the next generation. It follows the research and advice of experts. For instance, ownership and management responsibilities are transferred gradually. The senior generation both requires and facilitates the input of some capital into the business. In doing so the junior generation has a vested interest in the business and a real understanding and sharing of the risks involved. The transfer of capital, however, is limited. It is structured to enable to transfer without great sacrifices in lifestyle to either party. It is also structured to create equity payments for labor. It is a tool to take the junior generation off of the payroll and to make payments for labor in equity. Equity payments and transfers are tax advantaged in every avenue. This dramatically lowers labor costs and increases the ability of the farmer to increase income of the junior generation without increasing overall costs.

This methodology is easily transferrable to other types of business plans, for a larger grower with significant liability risk coming from multiple employees an LLC would likely be a good organization that this methodology could be applied to. However, as I have said before, the sole proprietorships and partnership are drastically underrated. Even something as complex as succession planning and management structure can be handled within the confines of a partnership. This sample, specific to grapes, can give you some ideas on how exactly it can be accomplished.

Please let me know (by either email or a phone call, 716.792.2800 extension 205) if you use this template to brainstorm ways you can compose an ownership agreement or as inspiration of important things to include in your agreement. Please do not construe this template as legal advice or rely on this template but use as inspiration for your own ownership agreement.

Sample Partnership Agreement (pdf; 114KB) -

Kevin Martin, Extension Educator, Business Management

Lake Erie Regional Grape ProgramMarch 7, 2013

Benefits & ClaimsThe 2012 crop year provided an unnecessary reminder of the role crop insurance plays in modern agriculture. Significant spring freeze events reduced regional yields by 50%. If crop insurance had been implemented by all growers at the 65% - 75% level of coverage, payments would have easily been in excess of $10,000,000. Premiums paid by regional growers would total approximately 900,000 annually. This illustrates the experience most growers have with crop insurance. In the event of a significant loss, the cash value of a claim typically covers the financial cost of premiums for 10 to 12 years.

Costs

Financial costs of crop insurance include an annual administrative fee and an annual insurance premium. The premium is based on the value of the maximum claim. For a typical Concord grower with a six ton average, premiums are approximately $30 per acre for 70% coverage. Changes in yield and price significantly impact the cost of the premium.

Crop insurance requires an investment in time, as well. Walking into the purchase of crop insurance with the expectation that there will be an annual investment in time immensely increases the probability that you will remain committed to the program. This investment of time has led to the decline in CAT (catastrophic) coverage. Typically CAT coverage results in claims once every ten or twenty years. Despite the extremely high level of premium subsidy, growers tend to give up CAT policies. The time associated with filing paperwork, filing potential claims and shopping policies appears onerous when the probability of a claim is very low.

Expected Value

On average the typical expected value of crop insurance is approximately $3 for each $1 in premium purchased. Block divisions, site conditions and production risk do have the ability to change the risk of loss significantly. Those with less production risk and other factors tend to see a lower than average expected value. That being said, for nearly all growers a gross expected value of $.90 would be entirely adequate to justify the purchase of crop insurance.

Business Management Contact:

Andrew Holden, Business Management Educator

Mobile (call or text): (716) 640-2656

Office: (716) 792-2800

Email: AZH6192@psu.edu